GTL Infrastructure (OTCPIL) hasn’t made a profit in the last five years. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over half a decade GTL Infrastructure reduced its trailing twelve month revenue by 3.6% for each year. Fear of becoming a ‘bagholder’ may be keeping people away from this stock.

GTL Infrastructure’s share price has risen 23% over the last year. The company’s five-year annualised TSR loss of 12% per year compares unfavourably to share price performance. This makes us a little wary, but the business might have turned around its fortunes.

If you’re anything like me, you won’t want to miss out on this free list of fast-growing businesses that insiders are buying.

Please keep in mind that the market returns mentioned in this article are market weighted average returns of stocks currently trading on IN exchanges.

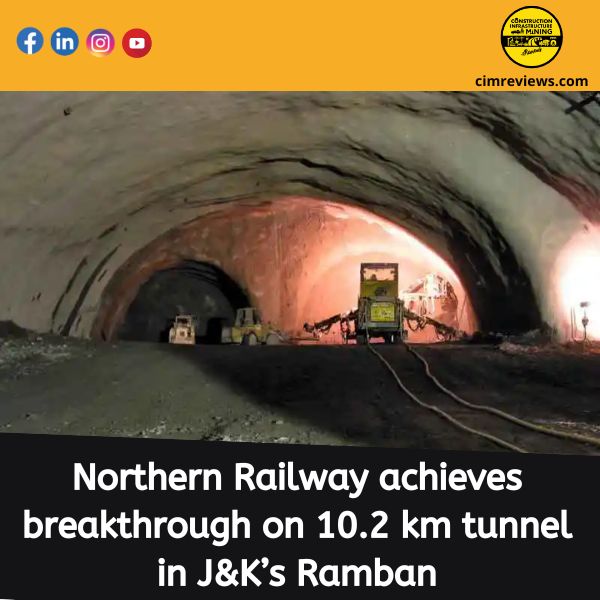

Construction, Infrastructure & Mining Group Media Publications

https://anyflix.in/, https://legalmatters.in/ & https://ihtlive.com/

%20/23%20cimr%204.jpg)